Compare Medigap Plans: Find the Best Fit for You

Many of the plans featured here are available through our partner, HealthCompare, who may compensate us when you enroll in a plan. This does not influence our evaluations. Our opinions are our own, based on our independent research. Learn more about how we make money.

Compare Plans in your area with your ZIP Code

Medigap plans fill the gaps in Original Medicare, covering out-of-pocket costs like copayments, coinsurance, and deductibles. With ten standardized plans available, choosing the right one can feel overwhelming. This guide will help you compare Medigap plans and find the best fit for your needs.

What Are Medigap Plans and How Do They Work?

Medigap plans, offered by private insurers, supplement Original Medicare by covering costs like deductibles and copayments. All Medigap plans are standardized, meaning a Plan G provides the same coverage regardless of the insurer. However, prices vary, so it’s essential to compare costs.

Why Should I Compare Medigap Plans?

Comparing Medigap plans helps you find the best balance between coverage and cost. While coverage is standardized, premiums and additional benefits vary between insurers, so shopping around is key to getting the coverage you want at an affordable price.

The following Medigap comparison chart offers a quick rundown of what each plan offers.

Source: How to Compare Medigap Policies.

Choosing a Medigap Policy is a good starting point. However, before you can choose, it's best to understand Medicare's costs fully.

What Costs Do Medigap Plans Cover?

Medicare Supplement plans help cover out-of-pocket costs for Medicare Part A and B, including deductibles, coinsurance, and excess charges. Plans F and G offer the most comprehensive coverage, while Plan N offers a lower-cost option with some copays.

How Medigap Plans Help with Overall Costs

Medigap plans help cover the gaps in Medicare coverage, which can be significant when considering the costs associated with hospital stays, outpatient care, and other services. Here’s a quick breakdown of the out-of-pocket costs in Original Medicare that Medigap plans can help you manage:

- Hospital Deductible and Coinsurance : The Part A deductible of per benefit period and daily coinsurance costs for extended hospital stays can quickly add up. Medigap Plan F, G, and N cover this cost.

- Skilled Nursing Facility Coinsurance : After the first 20 days of care, Medicare requires you to pay a daily amount ( in \) for skilled nursing facility care. Medigap plans help cover this expense.

- Part B Deductible and Coinsurance : Outpatient care can also be expensive, especially with the 20% coinsurance required after you meet your Part B deductible (\ in \). Medigap plans can significantly reduce these out-of-pocket expenses.

- Excess Charges : For those who see providers that do not accept Medicare assignment, excess charges can be an unexpected cost. Medigap plans that cover excess charges protect you from these fees.

Additional Benefits and Considerations

While Medicare Supplement plans offer significant financial protection by covering many out-of-pocket expenses associated with Medicare Part A and Part B, they do not cover everything. For instance, Medigap plans do not cover:

- Prescription Drugs : You must enroll in a Medicare Part D plan for prescription drug coverage.

- Long-Term Care : Medigap does not cover long-term care , such as extended stays in nursing homes beyond what Medicare covers.

- Dental, Vision, and Hearing : Routine dental care, vision care, and hearing aids are also not covered by Medigap plans. You may need to seek separate dental and vision insurance or pay out of pocket for these services.

Medigap plans are standardized across all states (except for Massachusetts, Minnesota, and Wisconsin, which have different plans). This means that regardless of the insurance company, the benefits of each plan type (e.g., Plan A, Plan G) are the same, making it easier to compare costs.

How Much Do Medigap Plans Cost?

Medicare Supplement plans are standardized, but policy prices are set by the individual insurance companies selling them. Companies set their monthly premium rates in one of three ways:

- Attained-age-rated: Monthly premiums are based on age at the time of purchase. Premiums increase as you age.

- Community-rated: Monthly premiums are the same for everyone in the policy, regardless of age.

- Issue or entry age-rated: Monthly premiums are lower if you purchase the policy at a younger age. Rates do not increase with age.

The attained-age rating method is the most common method used.

You May Also Like: Average Cost of Supplemental Insurance for Medicare

In addition to the rating method, your age, gender, location, and tobacco use also influence rates. The best way to get the rates available is to ask us for a free quote.

NOTE: Some insurers charge a one-time policy fee, generally no more than $25. Some companies offer a household discount if you and your spouse have a policy. Fees and discounts are available in our free report.

Which Medigap Plan Is Best?

Medicare Supplement Plans F, G, and N are the most popular plans, but are they the best? Not necessarily. When considering which Medicare Supplement Plan is best for you, you must identify your current and future healthcare needs. This is the only way to determine if a particular supplement is better for you.

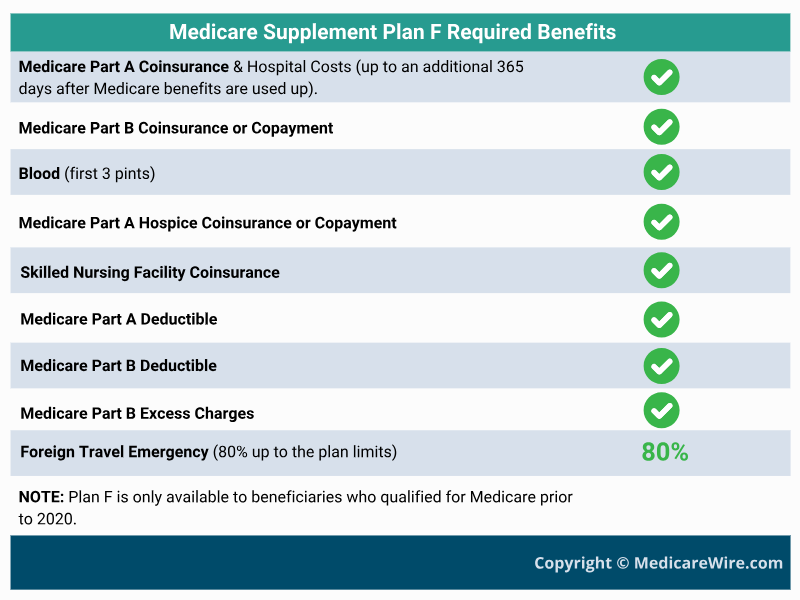

Plan F

Medigap Plan F offers the most comprehensive coverage allowed by Medicare. It covers all deductibles, coinsurance, and copayments in Original Medicare. This plan is only available to individuals who qualified for Medicare before January 1, 2020.

Related: Medicare Plan F vs Plan G: Which is Better?

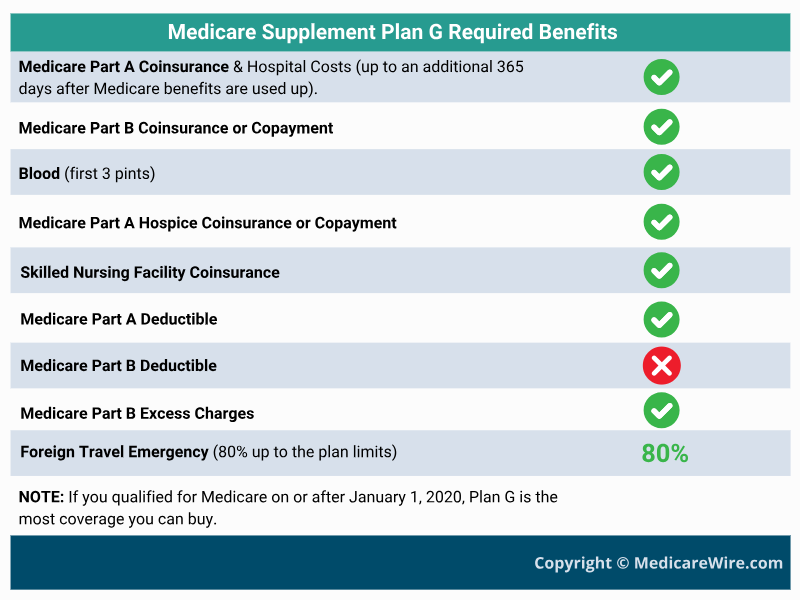

Plan G

If you want comprehensive coverage but don't qualify for Plan F, then Plan G is what you want. Plan G covers all Original Medicare costs except the Part B deductible. And, in most cases, it's more affordable than Plan F when you factor in the deductible.

Also See: Medicare Plan G Pros and Cons

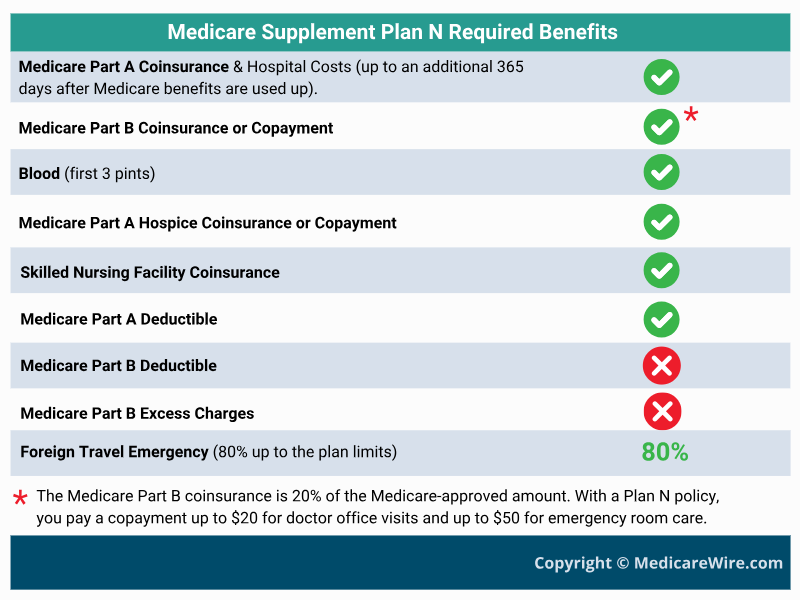

Plan N

If you are a healthy individual, Plan N might offer the best balance of coverage vs. cost. The reason Plan N works so well for healthy people is that they don't use a lot of medical services. As a result, the monthly premiums are often 20% to 30% lower than Plan G. Even though this plan does not cover Part B excess charges, you pay a small copay to see your doctor and use the emergency room.

Also See: Medicare Plan N vs Plan G

What are the Best Medigap Companies

Several top insurers offer Medicare Supplement plans:

- AARP/UnitedHealthcare : Largest provider, with dental and vision add-ons.

- Mutual of Omaha : A long-established insurer with competitive rates.

- Humana : Offers extra perks like SilverSneakers memberships and vision/dental options.

- Blue Cross Blue Shield: An association of 34 independent companies in all 50 states, including Anthem, Highmark, Premera, Regence, Wellmark, and Florida Blue.

- Aetna: Now part of CVS Health, Aetna offers various plan options and benefits at competitive rates.

Who Is Eligible for Medigap?

You’re eligible for Medigap if enrolled in Medicare Part A and B. For those under 65, availability varies by state. Your best time to enroll is during your Medigap Open Enrollment Period, when you won’t face medical underwriting.

Also See: Why Can You be Denied a Medicare Supplement Plan?

If you have a Medicare Advantage plan , you are not eligible for a Medicare Supplement without switching back to Original Medicare. And, if you are under age 65 and have Medicare due to a disability, be aware that Medicare does not guarantee coverage, but a few states do.

For More Information: Medicare Supplement (Medigap) Plans: Coverage, Costs, and Eligibility

How To Enroll in a Medigap Plan

To enroll in a Medigap plan:

- Sign up for Medicare Part A and Part B.

- Use our tool or visit Medicare.gov to find insurers in your state.

- Compare costs and choose a plan that fits your needs.

FAQs About How to Compare Medigap plans

What Medigap plan is the most popular?

Historically, Plan F held the top spot, but it's no longer an option for those new to Medicare after January 1, 2020. For this reason, Plan G and Plan N have taken the lead. Plan G covers everything Plan F did except for the Part B deductible.

Plan N has also gained traction because its premiums are generally lower than Plans F and G, even though it comes with copays for doctor visits and some emergency room visits. Popularity doesn't equal best for you, though. Choosing a plan is all about weighing your own needs and budget.

What is the downside to Medigap plans?

While Medicare Supplement Insurance plans help manage out-of-pocket expenses, it comes with monthly premiums. It also doesn't cover every healthcare need – you'll still need separate plans for dental, vision, hearing, and long-term care.

Finally, it can get a bit pricey if you develop health issues down the road, especially with attained-age-rated plans.

What is the average cost of a Medigap plan?

The average cost of a Medigap plan varies widely. Factors that affect the price tag include the specific plan, your age, gender, health status, location, tobacco use (if any), and even whether you’re married or single.

To understand Medigap plan costs, get quotes from various insurance companies, like Cigna, Humana, or AARP through United Healthcare. These are companies offering nationwide Medigap plans. UseMedicare.gov to check if a specific insurance company sells Medigap plans in your state.

What is the difference between Medigap plans?

Medigap plans differ primarily in what they cover and how much they cost. Some, such as Plan G, offer more comprehensive coverage and, therefore, come with higher premiums.

Plans with lower premiums typically require more out-of-pocket costs for specific services, like Plan N. When you compare Medigap plans, you should weigh the coverage you desire against your financial capacity.

Conclusion

Finding the best Medigap plan to cover those Medicare gaps isn't about just going with the crowd. Carefully compare Medigap plans based on coverage, costs, and personal health needs. And for a deeper dive, your State Health Insurance Assistance Program (SHIP) https://www.shiphelp.org/ , or even Medicare.gov ( https://www.medicare.gov/ , or 1-800-MEDICARE), can offer a guiding hand.

Figuring out which Medigap plan works for you takes time and careful thought. However, when you compare Medicare Supplement Insurance plans, keeping your specific needs and budget in mind is crucial. Reach out to a certified senior advisor or trusted financial advisor. Remember, getting help can be invaluable in making these vital healthcare choices.

Best Medigap Plans by State

Citations and References

- 2022: Guide To Choosing A Medigap Policy, Medicare.gov, Accessed January 30, 2023

- Original Medicare (Part A and B) eligibility and enrollment, CMS.gov, Accessed January 30, 2023

- How to compare Medigap policies, Medicare.gov, Accessed January 29, 2023

- Costs of Medigap policies, Medicare.gov, Accessed January 28, 2023

- Find a Medicare plan, Medicare.gov, Accessed January 28, 2023

- How to get prescription drug coverage, Medicare.gov, Accessed January 28, 2023

- When can I buy Medigap?, Medicare.gov, Accessed January 28, 2023

- Switching Medigap policies, Medicare.gov, Accessed January 26, 2023

- What’s Medicare Supplement Insurance (Medigap)?, Medicare.gov, Accessed January 26, 2023

- Medigap & Medicare Advantage Plans, Medicare.gov, Accessed January 26, 2023

- VA health care and other insurance, VA.gov, Accessed January 26, 2023

- AARP/UnitedHealthcare Medicare Supplement Reviews. MedicareGuide.com, Accessed January 26, 2023

- AARP History. AARP.org, Accessed January 26, 2023

- AARP® Medicare Supplement Insurance Plans insured by UnitedHealthcare. AARP Medicare Plans, Accessed October 15, 2022

- Financial Strength and Credit Ratings. Cigna.com, Accessed 9/22/2021.

- Cigna Company History. Cigna.com. Accessed October 15, 2022

- Financial Strength. MutualOfOmaha.com, Accessed October 15, 2022.