Medicare Supplement Plan F (Medigap Plan F) is the most comprehensive Medicare supplement plan available. This Medigap plan covers all Original Medicare deductibles, coinsurance, and copayments, leaving you no out-of-pocket costs on all Medicare-approved services.

(People often refer to Plan F as Medicare Part F or Medigap Part F, but the correct term is Plan F. Only Medicare organizes its services in Parts. Private Medicare insurance has plans.)

Find Plans in your area with your ZIP Code

Previously, Medicare Plan F was the best-selling Medigap plan among Baby Boomers aging into Medicare. In 2019, about 57% of all Medicare supplements sold were the Medicare Plan F policy. For people getting their benefits as of January 1, 2020, Medigap Plan G is the most popular.

The beauty of Medicare supplement insurance is that it pays its portion after Medicare to help cover what would normally be your costs. Unlike Medicare Advantage, a Medigap plan does not replace any part of your Medicare coverage. Instead, it works in lockstep with Medicare to cover your major medical costs. When you have a Medigap Plan F policy, all of your Medicare-covered costs are paid, and you never receive a bill.

Who Qualifies for Medicare Plan F?

You must be enrolled in both Medicare Part A (hospital coverage) and Part B (medical coverage) to apply for a Plan F policy. Once enrolled, then you are eligible to apply for a Medicare supplement Plan F.

However, as of 1 January 2020, only people who turned age 65 prior to January 2020 are eligible for Plan F benefits (due to Congress eliminating future sales of this plan). If you turned age 65 before 2020, but you are still working and have group health insurance through your employer, you’re grandfathered in and have the right to get a Medicare Plan F policy.

For everyone else, Medicare Plan G is the most extensive policy you can buy.

How Does Medicare Plan F Work?

When you add a Medicare Supplement Plan F to your Original Medicare coverage, you have the most comprehensive coverage available. No other plan offers more benefits.

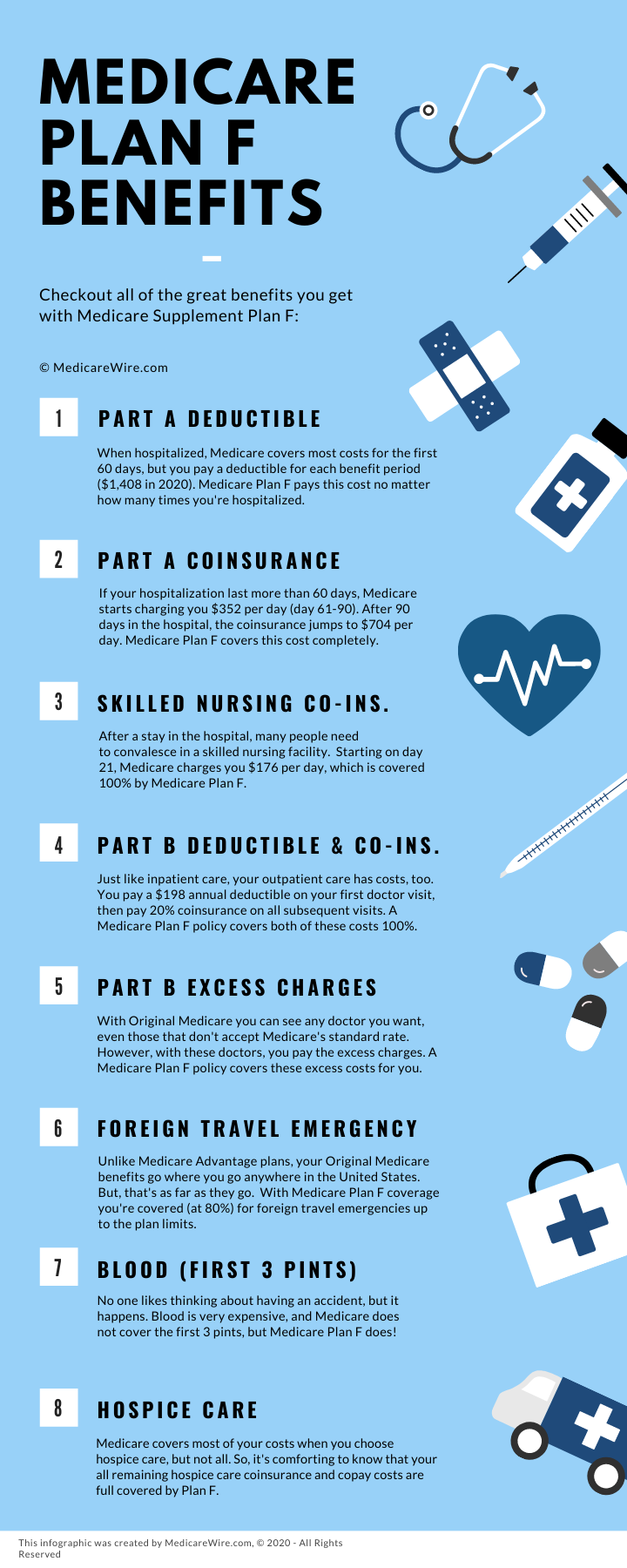

There are nine costs that Plan F covers for you:

- Medicare Part A Coinsurance & Hospital Costs

- Medicare Part A Skilled Nursing Facility Coinsurance

- Medicare Part A Deductible (per benefit period)

- Medicare Part A Hospice Care Coinsurance or Copayment

- Medicare Part B Deductible (annual)

- Medicare Part B Coinsurance or Copayment

- Medicare Part B Excess Charges

- Blood (first 3 pints)

- Foreign Travel Emergency

These are all of the shared costs baked into the Original Medicare system, which is designed to cover about 80% of your major medical. Without a Medigap plan, you pay the nine costs listed above out-of-pocket. With a Medigap Plan F policy, Medicare pays its share first then sends the rest of the bill to your Medigap plan. You never have to fill out a claims form and wait for reimbursement. All payments are taken care of for you automatically.

With Plan F You’ll Never Pay a Doctor Copay Again

One of the reasons Medicare Plan F is so popular is that it covers all of the gaps in Original Medicare, both big and small. This includes that pesky 20% copayment that Medicare Part B does not cover when you see your doctor and have lab work done.

With a Plan F policy, you have no out-of-pocket costs at your doctor’s office. None. Nada. Zip. This is why so many people think Plan F is the best Medicare supplement plan available. And, it’s not just the copays at your doctor’s office that get covered. All cost-sharing is covered at 100% when you have a Medicare Supplement Plan F.

When you have Medicare Plan you have first-dollar coverage. This means that, once Medicare pays its share of your claims, your Medigap Plan F pays the rest leaving you with no out-of-pocket costs.

A Plan F policy, regardless of which insurance company you buy it from, covers 100% of your Medicare Part A hospital deductible and your Medicare Part B medical deductible. In fact, it covers every bit of what Medicare Part B leaves for you to pay. And, Plan F pays all of your excess charges. That means you can see any doctor you want, even if they don’t accept Medicare’s assigned rates for services. The extra 15% that these doctors charge goes straight to your Part F Plan, and you don’t even have to get a referral!

Plan F is Guaranteed Renewable… Medigap for Life!

Once your Plan F is issued, it’s yours for life. Your coverage can’t be canceled due to your health or the number of claims you make. All you have to do is continue to pay your premiums.

With all of these benefits, it’s plain to see how Medicare supplement Plan F coverage buys you peace of mind. Plus, no matter which insurance company you choose, the benefits are identical. And, if you switch carriers in the future, to get a better rate, your benefits will remain the same.

How Much Would I Pay Without Medicare Plan F?

Your costs in Medicare are based on the healthcare services you use. Healthy people, who only see their doctor for regular checkups and minor illnesses, may rarely exceed the cost of the annual Medicare Part B deductible. However, a person with one or more chronic conditions could have doctor and hospital bills that run into the thousands. But, here’s the thing. Even if you can afford to pay your regular doctor visits out of pocket, chances are you can’t afford an extended stay in the hospital for a critical illness, like cancer.

A Medigap Plan F policy is like full-coverage car insurance. You buy it because you have something that’s worth protecting. Here’s an example.

Let’s say you get the flu and come down with pneumonia and your doctor admits you so you can get the proper antibiotics and respiratory treatments. You may only be in the hospital for a few days, but without a Medigap Plan, Medicare is going to send you a bill for $1,408 (2020 rate) for your Part A deductible and another bill for your Part B services (doctor, medications, etc). When all is said and done, your bout with pneumonia will set you back $2,000 or more. That’s exactly what happens to people without Medigap coverage. And there’s no cap or annual limit on how much you can be billed.

When you have a Medigap Plan F policy and come down with pneumonia, or any other illness, you don’t see any of those bills. What you’re paying for each time you write a check for your policy is peace of mind knowing that you’re covered.

Here’s another way to look at Medigap insurance. Let’s say that you are healthy and that a serious illness, like pneumonia, only comes your way every five years or so. And, let’s say that your Part F premium is around $150 per month. That means, over the period of a year you pay $1,800 in premiums, but you’re covered for any amount of medical care, including hospitalization, skilled nursing care, and rehabilitation if that’s needed, too.

Like the MasterCard commercials say… for everything else, there’s Medigap Plan F. Priceless!

How Much Does Medicare Plan F Cost?

The quotes you get from your insurance agent for Medicare Plan F policies will vary based on several factors, including your gender, zip code, and tobacco status. In most areas, you can find plans for around $120 to $150 per month for a woman turning 65, but there are some areas where Medicare Plan F policies cost a bit more.

In most cases, men pay a bit more for Medicare Plan F. And, if you are or were a tobacco user your rates will be higher.

If you and your spouse are both getting a Medigap plan, be sure to ask your agent to show you companies that offer discounts. It’s not uncommon for these discounts to bring you 10% or more savings.

When Can I Change My Medigap Plan F Policy?

An annual review of Medicare supplement insurance rates will save you a lot of money. As with Medicare Part D plans for your prescriptions, there’s no way to know if you’re still getting a good deal unless you shop.

We find that many people are afraid to shop for new plans because don’t think their application will be accepted. Your insurance agent can help you with that. Talk to your agent and let them know if you have a health condition. If you can honestly answer “no” to the simple health questions, you shouldn’t have any issues.

With that said, you can change plans at any time of year. There’s isn’t a specific open enrollment period with Medigap plans are there is with Medicare Advantage. The only requirement is that you can make it through medical underwriting.

Ask your agent to review the health questions with you each year. If you can pass them, it’s likely that your agent will be able to find a better rate every few years.

If you don’t already have an agent, call 1-855-728-0510 (TTY 711) and speak with a licensed HealthCompare insurance agent. There’s no obligation, and they offer more plan options than any other national agency.

What About Plan G? Is Plan G Better Than Plan F?

It’s a good idea to compare these two top plans. Like Plan F, Medicare Plan G is very comprehensive in its coverage. In fact, it offers the exact same coverage as Plan F, with the exception of the Part B deductible.

However, the benefit of Plan G, and the reason that it’s growing in popularity, is that the combined cost of Plan G premiums plus the Part B deductible is usually less than Plan F. So, for people looking at total cost vs. convenience, Medicare Plan G is a better value.

We suggest that you ask your insurance agent to walk you through how Plan G might help you keep more of your money. Get quotes for both Plan F and Plan G policies and see for yourself how much you can save. To save even more money, ask your agent to show you Plan N, as well.

Call 1-855-728-0510 (TTY 711) for plan assistance.

If you qualify for Medicare and don't know where to start, MedicareEnrollment.com, an independent HealthCompare insurance broker, has licensed insurance agents who can help you with your Medicare enrollment options, Mon-Fri, 8am-9pm , SAT 8am-8pm EST.